Take a quick peek at the enhancements and updates for 2026

Foreign Service Benefit Plan 2026 Premiums

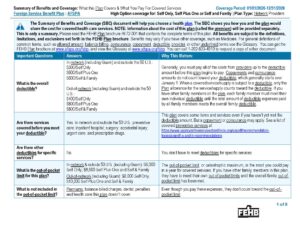

| Enrollment Type | ENROLLMENT code | Bi-Weekly | Monthly |

|---|---|---|---|

| Self Only | 401 | $100.36 | $217.45 |

| Self Plus One | 403 | $257.96 | $558.91 |

| Self & Family | 402 | $248.27 | $537.93 |

Note: Two-person families are not required to enroll in Self Plus One. They can opt to enroll in Self and Family (402).

2026 Foreign Service Benefit Plan Benefit Enhancements & Updates

Your share of the premium rate will increase by $7.00 for Self Only, or increase by $6.44 for Self Plus One, or increase by $17.32 for Self and Family.

FSBP will expand coverage for cryopreservation and storage costs to include all members experiencing infertility, including those for medical reasons other than iatrogenic infertility. FSBP will not set any annual dollar limits or time restrictions on egg or sperm storage, as long as the member stays enrolled in FSBP.

See section 5(a), Infertility Services of the Plan brochure.

FSBP will increase the out-of-pocket maximums for catastrophic protection for both in-network providers, including those in Guam, and out-of-network providers and providers outside the United States.

- The in-network maximum will increase to $6,000 from $5,000 for the Self Only option, and to $8,000 from $7,000 for the Self Plus One and Self and Family options.

- The out-of-network maximum will increase to $8,000 from $7,000 for the Self Only option, and to $10,000 from $9,000 for Self Plus One and Self and Family options

FSBP will add a cost share for non-emergency services at CVS Minute Clinics and walk-in clinics (other than in a CVS Minute Clinic). These services will be subject to the calendar year deductible.

- For in-network (including Guam) and for providers outside of the U.S., members will pay 10% of the Plan allowance.

- For out-of-network (including Guam) members, they will pay 30% of the Plan allowance and any difference between FSBP’s allowance and the billed amount.

FSBP will exclude coverage for gender reassignment surgeries and hormonal drugs for the purpose of sex-trait modification.

If you are mid-treatment under this Plan, within a surgical or chemical regimen for sex-trait modification for diagnosed gender dysphoria, for services for which you received coverage under the 2025 Plan brochure, you may seek an exception to continue care for that treatment. Please call 800-593-2354 for additional details, forms and requirements regarding the continuation of care process. If you disagree with our decision on your exception, please see Section 8 of the Plan brochure for the disputed claims process.

Individuals under age 19 are not eligible for exceptions related to services for ongoing surgical or hormonal treatment for diagnosed gender dysphoria.

FSBP will require members prescribed GLP-1 medications for weight loss under an obesity diagnosis to participate in the lifestyle management part of Encircle Rx. This includes using Teladoc Health’s Advanced Weight Management platform, which offers a free smart scale and an in-app program. Members must weigh in at least four times within a rolling 30-day window and complete four engagement activities within the app. Participation in this program is mandatory.

GLP-1 drugs for weight loss will be covered* if you meet and your provider certifies certain conditions such as, but not limited to:

- Body mass index (BMI) of 32 or greater when you began taking the drug; or

- BMI of 27 or greater and documented diagnosis of at least two comorbidities when you began taking the drug; and

- Patient has engaged in a trial of behavioral modification and dietary restriction for at least 3 months.

In addition to meeting these clinical requirements, you must enroll in Teladoc Health.

Here’s how it will work:

- Enroll in the program by visiting https://www.teladochealth.com/livongo/benefits/fsbp or using the Teladoc Health app on your mobile device.*

- Receive a smart scale in the mail.

- Each month, you will:

- Weigh in at least four times using your smart scale.

- Engage with the program at least four times. Engagements can include coaching sessions with certified health coach, tracking your meals, reading an educational article, and more.

- Teladoc Health will confirm your weigh-ins and engagements to Express Scripts to ensure continued coverage of and access to the GLP-1 weight loss drug.**

There is no charge for this program. There’s also no need to wait. You can go ahead and sign up for Teladoc Health’s program now and be on your way to sustained success.

*You must be enrolled in the program before your first fill or refill of a GLP-1 in 2026.

**Failure to follow the requirements of the program will result in loss of coverage for GLP-1 drugs for weight loss until member is compliant with program requirements.

FSBP will increase the prescription drug cost shares and remove the minimum prescription copayment for Tier II and Tier III drugs. The member will pay the lesser of the price of the drug or the Tier copay.

Network Retail :

- Tier I (Generic Drug): Copayment will increase to $12 from $10 copay for up to a 30-day supply

- Tier II (Preferred Brand Name Drug): Coinsurance will increase to 35% ($150 max) from 25% ($30 min; $100 max) for up to a 30-day supply

- Tier III (Non-Preferred Brand Name Drug): Coinsurance will increase to 45% ($300 max) from 35% ($60 min; $200 max) for up to a 30-day supply

- Tier IV (Generic Specialty Drugs): Coinsurance will increase to 35% ($240 max) from 25% ($150 max) for up to a 30-day supply

- Tier V (Preferred Brand Name Specialty Drugs): Coinsurance will increase to 35% ($240 max) from 25% ($200 max) for up to a 30-day supply

- Tier VI (Non-Preferred Brand Name Specialty Drugs): Coinsurance will increase to 50% ($480 max) from 35% ($300 max) for up to a 30-day supply

Network Home Delivery or participating Smart90® retail pharmacy:

- Tier I (Generic Drug): Copayment will increase to $20 from $15 copay for up to a 90-day supply

- Tier II (Preferred Brand Name Drug): Cost share will change to 35% coinsurance ($300 max) from $60 copayment for up to a 90-day supply

- Tier III (Non-Preferred Brand Name Drug): Coinsurance to 45% ($400 max) from 35% ($80 min; $500 max) for up to a 90-day supply

- Tier IV (Generic Specialty Drugs): Coinsurance will increase 35% ($240 max) from a 25% ($150 max) for up to a 90-day supply

- Tier V (Preferred Brand Name Specialty Drugs): Coinsurance will increase to 35% ($240 max) from 25% ($200 max) for up to a 90-day supply

- Tier VI (Non-Preferred Brand Name Specialty Drugs): Coinsurance will increase to 50% ($480 max) from 35% ($300 max) for up to a 90-day supply

The information here is a summary of the Plan’s benefits and features. All benefits are subject to the definitions, limitations, and exclusions set forth in our official FSBP Plan Brochure RI 72-001.

New Brochures for 2026

There are two ways to enroll in the Foreign Service Benefit Plan.

- 1. Use your agency's preferred method

- 2. Contact your agency's HR office

Download and fill out a Health Benefits Election Form (SF 2809) and submit to your Human Resources office.

Important:

You must remember your enrollment code and full name of the plan, Foreign Service Benefit Plan.

- Foreign Service Benefit Plan

| Enrollment Type | ENROLLMENT code |

|---|---|

| Self Only | 401 |

| Self Plus One | 403 |

| Self & Family | 402 |

There are two periods when Federal employees and retirees can enroll for the first time or switch their enrollment type.

All actively working or retired federal employees can enroll in, change or cancel their health plan during Open Season, which is typically the second Monday of November through the second Monday of December each year. Learn more.

New Employees

If you’re a new Federal employee eligible for Federal Employee Health Benefits (FEHB) coverage, you have 60 days from your start date to enroll in a health plan.

Qualifying Life Event

You may make changes to your health plan outside of Open Season if you have a qualifying life event. These include getting married, having a baby, getting divorced or you move outside of the plan’s coverage area. Learn more.

Questions about enrollment? Send us a message here or call 202-833-4910.

FSBP is HIPAA compliant. The confidential medical information (i.e., Protected Health Information (PHI)) that you provide to us is kept strictly confidential and secure in our records. Click here for our Notice of Privacy Practices.