Take a quick peak at the enhancements and updates for 2024

Foreign Service Benefit Plan 2024 Premiums

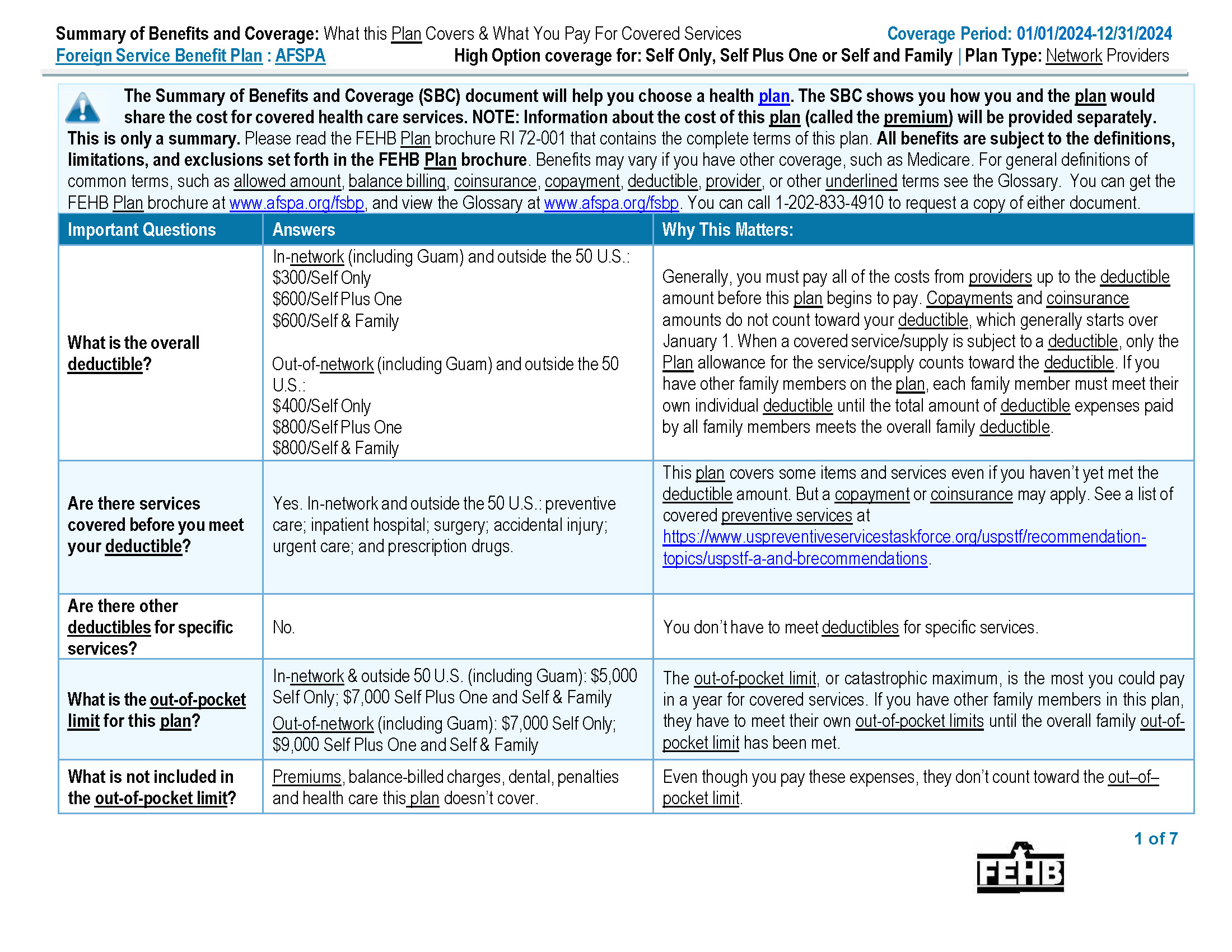

| Enrollment Type | ENROLLMENT code | Bi-Weekly | Monthly |

|---|---|---|---|

| Self Only | 401 | $82.62 | $179.01 |

| Self Plus One | 403 | $211.30 | $457.82 |

| Self & Family | 402 | $204.38 | $442.83 |

Note: Two-person families are not required to enroll in Self Plus One. They can opt to enroll in Self and Family (402). We invite you to review our premiums relative to other high option plans in the FEHB Program.

2024 Foreign Service Benefit Plan Benefit Enhancements & Updates

-

Slight Premium Increase See back cover of FSBP Brochure

Your share of the premium rate will increase by $4.31 for Self Only, or increase by $12.01 for Self Plus One, or increase by $10.65 for Self and Family.

-

Expanded coverage for infertility services See section 5(a) under Infertility Services of the FSBP brochure

The Plan will cover infertility services with no annual dollar limits or cycle limits for artificial insemination (AI), in vitro fertilization (IVF), intravaginal insemination (IVI), intracervical insemination (ICI), and intrauterine insemination (IUI), intracytoplasmic sperm injection (ICSI), embryo transfer and gamete intrafallopian transfer (GIFT) and zygote intrafallopian transfer (ZIFT). Prior approval is required for Comprehensive Infertility and Advanced Reproductive Technology (ART) even if rendered outside the 50 United States.

If you're a member residing or receiving treatment in the U.S., you'll need to visit a participating provider from the Institute of Excellence (IOE) for infertility treatment.

Members residing or receiving treatment outside the 50 United States – including those residing or receiving treatment in Guam and other U.S. territories – can receive coverage for services from any provider. -

Updated our prior approval list See Section 3, under How you get care of FSBP Brochure

The Plan no longer requires prior authorization for cataract surgery.

-

Added LabCorp as an option for Biometric Screening See section 5(h), Wellness and Other Special Features

The Plan offers Quest Diagnostics and LabCorp to members to obtain biometric screening.

-

Changes to various wellness programs See section 5(h) of the FSBP Brochure

The Plan no longer offers the Mediterranean Wellness Program.

The Plan no longer offers the Kidney Support Program. The Plan’s Care Management nurses continue to support members identified with kidney disease under the Care Management Program.

The Plan has added Maven, a digital health platform to support members through family planning, fertility, pregnancy, parenting and pediatrics, and menopause. -

Added Children’s National Hospital to our Overseas Second Opinion program See section 5(h) of the FSBP Brochure

In addition to The Clinic by Cleveland Clinic, the Plan has added Children’s National Hospital to provide members who receive treatment in foreign countries access to Virtual Second Opinions

-

Increased the Plan maximum for massage therapy, chiropractic, and acupuncture services See section 5(a) of the FSBP brochure

The Plan has increased the Plan maximum for massage therapy, chiropractic, and acupuncture services from $60 to $75 per visit for each service.

-

Expanded coverage for gender affirming surgeries See section (5b), under surgical procedures and reconstructive surgery

The Plan has added coverage for pectoral muscle implants, hair removal, liposuction/lipofilling specific to gender affirmation, facial contouring surgeries, and voice modification. Prior approval is required even if rendered outside the 50 United States for gender-affirming care services and surgeries.

-

Added a new FSBP-Express Scripts Medicare® Prescription Drug Plan (PDP) See section 9, Medicare prescription drug coverage (Part D)

The Plan is now offering FSBP – Express Scripts Medicare® Prescription Drug Plan (PDP) for Medicare eligible, retired members age 65 and above with Medicare Parts A and/or B.

-

Decreased the FSBP-MAPD annual catastrophic protection out-of-pocket maximum See section 9 of the FSBP brochure

The Plan decreased the FSBP-MAPD annual catastrophic protection out-of-pocket maximum from $3,500 to $2,000

The information here is a summary of the Plan’s benefits and features. All benefits are subject to the definitions, limitations, and exclusions set forth in our official Plan Brochure RI 72-001. We look forward to bringing you these new and enhanced offerings beginning January 1, 2024.

New Brochures for 2024

- Self Only: 401

- Self Plus One: 403

- Self Plus Family: 402

- Use your agency's preferred method

- Contact your agency's HR office

Download and fill out a Health Benefits Election Form (SF 2809) and submit to your Human Resources office.

There are two periods when Federal employees and retirees can enroll for the first time or switch their enrollment type.

All actively working or retired federal employees can enroll in, change or cancel their health plan during Open Season, which is typically the second Monday of November through the second Monday of December each year. Learn more.

New Employees

If you’re a new Federal employee eligible for Federal Employee Health Benefits (FEHB) coverage, you have 60 days from your start date to enroll in a health plan.

Qualifying Life Event

You may make changes to your health plan outside of Open Season if you have a qualifying life event. These include getting married, having a baby, getting divorced or you move outside of the plan’s coverage area. Learn more.

Questions about enrollment? Send us a message here or call 202-833-4910.

FSBP is HIPAA compliant. The confidential medical information (i.e., Protected Health Information (PHI)) that you provide to us is kept strictly confidential and secure in our records. Click here for our Notice of Privacy Practices.